We interviewed the Shadhin team to learn about exciting new developments, projects for uplifting women, and partnerships they have formed during the Implementation Phase.

How did you come up with this idea, what is your origin story?

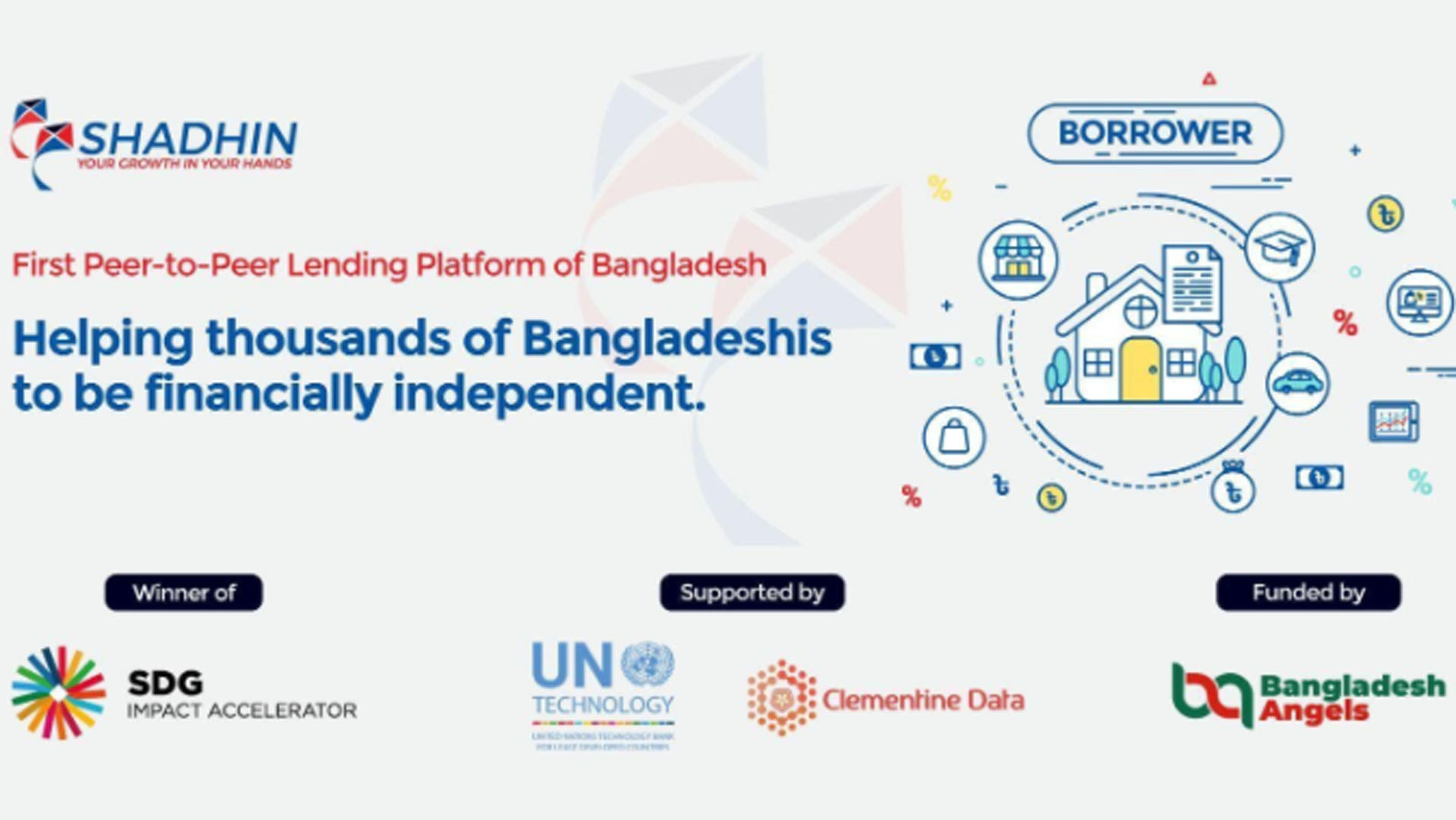

It was a regular day of our friends catching up and one conversation led to another with us talking about how it was difficult for us to get a loan from a bank, even after we had studied abroad and came back to Bangladesh. As we were discussing this, we realized how hard it must be for an average middle-class person in the country to have access to funds, capital, or personal loans. This is how our journey of Shadhin began with Kashfia Mahmud, our Co-Founder and CEO.

At that point we decided to talk to as many people we know across all socio-economic classes and one thing was consistent, except for the upper income of the society, it was very difficult for an average Bangladeshi to get a loan. Then, we realized there must be an easy and efficient way for average Bangladeshis to get access to finance. That’s why the idea of Peer to peer/Marketplace lending came to fruition. We got funded by Bangladeshi Angels via Bangladesh Angels Network along the way.

Why did you apply for the SDG Impact Accelerator Financial Inclusion program funded by the Turkish Government and run through the partnership of the Ministry of Foreign Affairs of the Republic of Turkey, UNDP and UN Technology Bank?

When we saw that there was an Accelerator Program aimed to drive Sustainable Development goals, we realized we had to apply for this opportunity. The idea, theme, and vision of the SDGia program was 100% aligned to what we were planning to do. It was a global competition and our opportunity to meet, connect and learn from the fintech space. There was no way we were not going to take up this opportunity.

Which 17 of the Sustainable Development Goals are your main focuses?

While Financial Inclusion is present in 8 of the 17 goals, the critical goals we focus on are SDG 8 – Decent Work & Economic Growth and SDG 10 Reduced Inequalities. We believe enabling Bangladeshis to have access to finance will provide them with the opportunity to solve their day to day, emergency, and personal needs without being prey to family members or loan sharks. Furthermore, those Bangladeshis looking to drive their businesses further, start a new business, with access to finance this will enable them to achieve their goals and thus reducing inequality.

What was your motivation behind Shadhin, and has it evolved?

Our initial goal is to have local and national impact. To be truly able to drive financial access and inclusion among average middle-class Bangladeshis. As this model improves and strengthens, we want to expand to other markets that are very similar in nature—where banks provide personal loans to high net worth, micro finance institutions cater to lower income and a gap exists among the middle class.

What kind of impact do you think Shadhin has had on people?

There are numerous examples, starting from a dad being able to pay for their child’s tuition fees, to a daughter paying for her mother’s emergency medical treatment, to the entrepreneur whose oven got damaged just before the busy season of sales. Shadhin impacts everyday people through small ways but enabling them to be at ease and having one less thing to worry about. We believe getting access to funds easily, especially during a critical period of their life will build trust that Shadhin can be there for any future financial needs, turn these one-time customers into loyal customers.

As a peer-to-peer banking marketplace in Bangladesh, where do you think Shadhin fits in Bangladesh’s financial environment?

Shadhin fits right between MFI and Banking Institutions. We are a P2P Lending and Lending Marketplace provider. We truly believe in the value of options. Financial environment is such that more options create better credit access and availability for the average consumer which ends up driving the ecosystem. We know that we will not be able to provide large funding and low rates like banks. However, we know that as a start-up, we will be able to provide quick, easy, and convenient options. As a marketplace, by cutting the “middlemen” and physical infrastructure needed to operate lending, it will drive efficiencies and reduce cost for the consumers.

You have held a webinar on financial literacy, would you like to explain it to us?

We launched an online show with 8 episodes called MONEY MATTERS. It was a broad show covering major aspects of savings, investments, lending, fraud, taxation, and other financial topics. We prepared an episode dedicated to women and finances. The idea of the show was to provide information and day to day knowledge on how women can better manage their finances. Generally, in our society we do not have open conversations about money within a family unit. Money discussions are one way street with the head of household making decisions without a collaborative approach. Our show was designed to break those barriers and encourage people to talk to their family and children about finances, including positives and negatives in an open and honest manner and bring some watchouts that people should have when it comes to investing and savings to light. We are also planning partnerships with Fatiha Polin and Sadia Jafrin.